What keeps you awake at night?

1802 days ago

1st January 2020?

The new IMO Sulphur cap of 0.5% for marine fuel emissions goes into effect 1 January 2020. No delays, no negotiation, it’s happening. Fuel and lubricant companies and suppliers are scrambling to understand and predict the market dynamics, what products are required and ultimately where they can make the most money. Ship owners are considering both Low Sulphur fuel options and technology that allow them to comply.

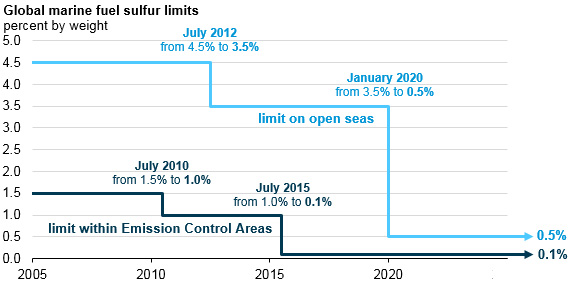

As IMO prepares to significantly tighten regulations on marine pollutants, the significance of their policy announced in October 2016 still remains a mystery for many regarding what to do next. The 0.5% Sulphur limit will go into effect on 1st January 2020 (see figure 1). At the time of writing this, it is little over 2 months away.

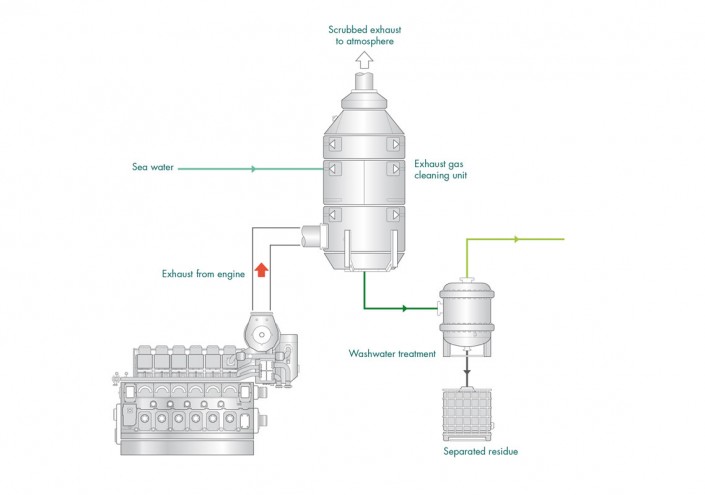

In many cases, to reduce emissions from ships, lower Sulphur fuels will be used. However, this is not a specific requirement of the regulation. The new emissions standard may be met by using approved technology, such as scrubbers (see figure 2), which clean the emissions before they are released into the atmosphere.

Specialised lubricants are required for the lubrication of the cylinder liners. Cylinder lubricants range in base number (BN) from 20 to 100, with 70 BN and 100 BN being the most common grades able to handle fuel ranging from 1.0% sulphur to 4.5% sulphur. Current cylinder lubricants may not be suitable for use with lower sulphur fuels. In addition to handling lower sulphur fuels, new cylinder oils will need to be fully compatible with other cylinder oils.

We understand from our suppliers that some new formulations are being tested, but we are unlikely to see these before January 1. Therefore, low-BN cylinder oil is recommended for use with low-sulphur fuel.

Options to consider during your restless night’s sleep:

Install scrubbers

Scrubbers remove SO2 from ships’ Exhaust (see figure 1). This would allow ships to continue using higher-sulphur fuels; these higher-sulphur fuels, however, may not be readily available in a few years.

The use of scrubbers will remove almost all harmful emissions from ships. Installing scrubbers is expensive estimated at $4-12m US. However, because of the significant savings on low-sulphur fuel the initial cost may be offset in the long term.

Switch to low-sulphur fuel

Most ships are expected to comply by using the new blends of fuel oil, which will be produced to meet the 0.5% limit on sulphur. Current low-sulphur fuel is expensive and new fuels to meet the new regulation will be even more so.

Switch to non-petroleum-based fuels

Ship operators also could switch to non-petroleum-based fuels such as LNG. However, a combination of technical and expensive modification of existing engines, combined with a severe lack of infrastructure may limit this option to a handful of supply locations.

Do nothing

Maybe this is why so many people are losing sleep! How can this even be an option? Well, there is a real lack of clarity on IMO inspection and enforcement.

Whilst IMO set the legislation, it is the responsibility of the country under whose flag each vessel is registered to enforce the Sulphur cap. No consistent plan is in place regarding how to enforce the sulphur limit.

Fuel and lubricants are estimated to account for 70% of a ships operating cost. Current estimates are that the price differential between high-sulphur fuel oil and 0.5% sulphur fuel widens to as much as $350 per tonne. This could lead to a strong financial incentive to burn non-compliant fuel and risk the consequences – but that may be at the expense of a good night’s sleep

Here at Bulugo we can’t tell you the best course of action above, that is your choice. However, we can ensure that you are paying the best price for whatever mix of bunker fuels and lubricants you decide on. The increased supply uncertainty that will come as a result of 2020, is the ‘Perfect Storm’ for traditional traders to exploit. We estimate that traders add between $3-15 per tonne to prices quoted by suppliers, leaving ship owners to feel exploited by the lack of price transparency. At Bulugo our model is simple and transparent – we put the ship owner in direct contact with the suppliers in any given port, thus cutting out the middle man (the trader). For the buyer, Bulugo is free. The supplier pays Bulugo $1 per tonne (fuel) or $0.10 per litre (lubricants) on delivery.

A tanker company with an estimated yearly consumption of 220,000 tonnes, who is buying via a trader applying a $5 per tonne margin, will have a $1.1m fuel bill per annum. Via Bulugo, at $1 per tonne fee paid by the supplier, with the tanker company saving approximately $880,000 per annum.

Register your interest in Bulugo: Start now

You may also be interested in

The Tug of War & Bunker Prices

150 weeks ago

2 Min read

Request Bunker Prices on-the-go

151 weeks ago

2 Min read